SEPA – Single Euro Payment Area

Single Euro Payment Area (SEPA)

Acronyms and general Information

What is SEPA?

The Single Euro Payments Area (SEPA) is a payment-integration initiative of the European Union for simplification of bank transfers denominated in euro. The project's aim is to improve the efficiency of cross-border payments and turn the fragmented national markets for euro payments into a single domestic one.

SEPA consists of the 28 EU member states, the four members of the EFTA (Iceland, Liechtenstein, Norway and Switzerland) and Monaco.

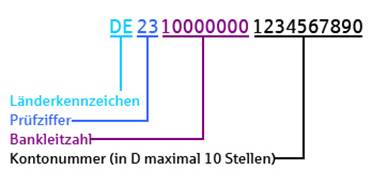

IBAN - International Bank Account Number

IBAN is an internationally agreed means of identifying bank accounts across national borders.

It contains a country-code, bank-code and account number.

BIC - Bank Identifier Code

A bank identifier code (BIC) is a unique identifier for a specific financial institution.

A BIC is composed of a 4-character bank code, a 2-character country code, a 2-character location code and an optional 3-character branch code.

Mandate Reference Number

Used in combination with the Creditor Identifier the unique Mandate Reference makes it possible to identify a mandate clearly with the effect that when SEPA direct debit is presented to a debtor, he is able to check the effective existence of the mandate or alternatively that the Debtor Bank is able to offer him such a service optionally.

Creditor-Identifier (Creditor-ID)

The creditor identification number is an account-independent and unique identifier for the direct debit creditor.

The Creditor Identifier, together with the SEPA Direct Debit form, is a mandatory feature in the mandate.

Source: Deutsche Bundesbank, Commerzbank

SEPA-Timeline

1st of February 2014:

National Migration End Date in euro countries for companies and SEPA direct debits.

February 2014 to February 2016:

Transitional period for consumers to use their “old” bank account numbers.

From 1st of February 2016:

All exemptions for EU-countries end at this date. The SEPA process is only accepted in all areas.

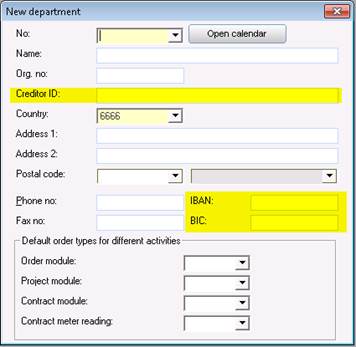

Impacts in Evatic Admin

Three more fields are added in the Department Screen in Evatic Admin

Evatic Admin -> Department:

- Creditor-ID

- IBAN

- BIC

This fields are available for Report-Designer:

- DeptIBAN (IBAN of your Department)

- DeptBIC (BIC of your Department)

- CreditorID (Creditor-ID of your Department)

Impacts in the Evatic Service modules

Customer-Screen

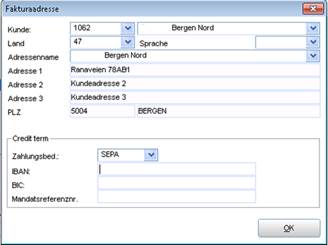

The necessary information for the SEPA-Payment integration can be entered directly in the Customer Screen.

The Address tab shows three fields for entering SEPA-data:

- IBAN

- BIC

- Mandate Reference Number

These fields are available only for invoice-addresses. Other addresses which are not set as invoice-address cannot be filled with SEPA-data.

If the customer selected a SEPA credit-term these fields are designated as mandatory. Saving an invoice address without SEPA-data is not possible.

This will ensure that the required data is presented in the invoices.

Select the SEPA credit term in the Details tab on Customer:

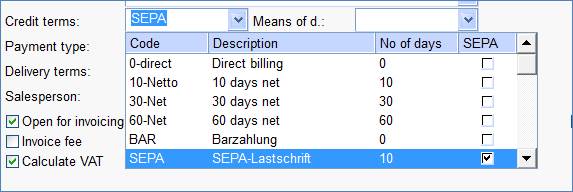

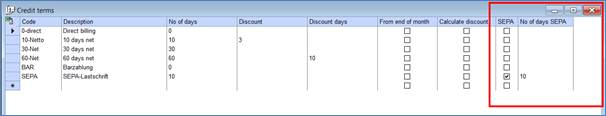

Credit terms

If the SEPA Direct Debit is used it must be defined in the credit terms.

To define a SEPA payment the credit term window shows two more columns:

- SEPA-checkbox: Check this checkbox if the credit term uses SEPA direct debit.

- No of days SEPA: The number of days between invoice and due date. If such credit term is set in the customer-screen, Evatic automatically determines the due date for the order based on the stored number of days.

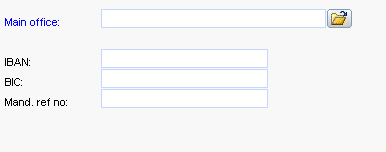

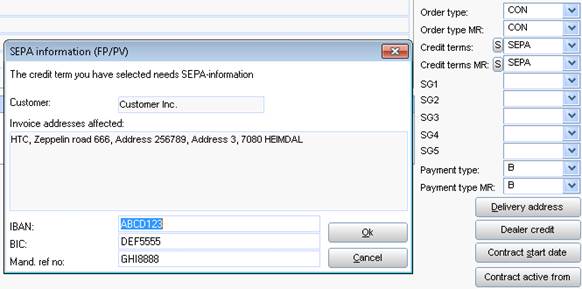

Impacts in the following processes in order-/contract-/customer-module

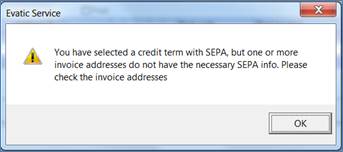

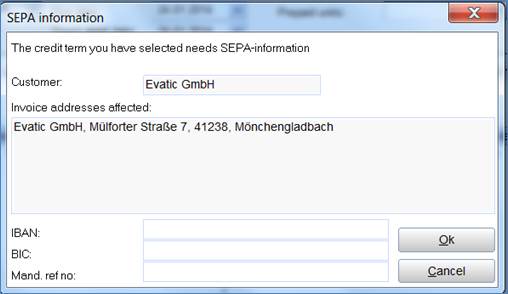

If the user selects a specific credit term (in which the SEPA checkbox is activated) in the order- or contract module, a notification-window is shown.

This notification shows the stored SEPA-information (IBAN, BIC, Mand. ref. no) from the customer-data. If there is no SEPA-information stored in the customer data, these fields must be filled manually.

Without the missing information the user is unable to create an invoice when the direct debit checkbox (SEPA) is clicked in credit terms on the Contract and/or Order.

Without stored SEPA-data it is not possible to create an invoice.

Note: Unless otherwise agreed, an invoice with SEPA direct debit has to be made 14 days before due date. The invoice-report in Evatic can be used to announce the direct debit date.

Further condition for SEPA Direct Debit is a valid mandate between creditor and debtor, which should be given in writing.

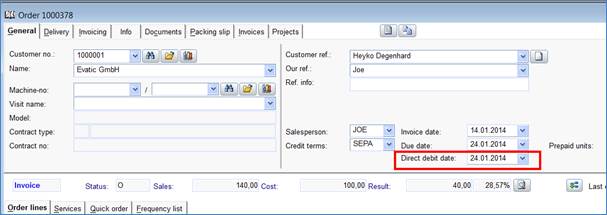

Order module

In the General tab one more drop-down is added:

- Direct debit date

Example:

This field is automatically filled when a payment term with SEPA has been selected. The direct debit date is automatically calculated according to the number of days that is stored in the SEPA credit term.

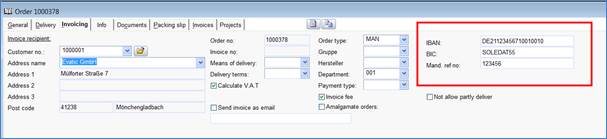

In the Invoicing tab three more fields are added:

- IBAN

- BIC

- Mandate Reference Number

Example:

If an invoice address is selected with stored SEPA data, this data is inherited directly in the order for SEPA related fields.

On the invoice layout, it is possible to integrate these fields. The following data fields for the Report Designer are available:

- DirectDebitDate

- OrderIBAN (IBAN from order/customer)

- OrderBIC (BIC from order/customer)

- MandateRefNo

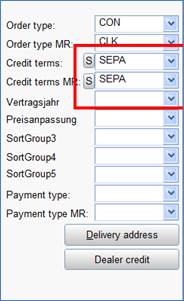

Contract module

Within the contract heading is the additional possibility to retrieve the stored SEPA information about a customer. An S-button shows the possibility to open the stored SEPA-data:

Click on the button to show the stored SEPA-data:

For fixed-price and volume lines separate invoice recipients can be chosen. If an invoice-receiver is chosen with stored SEPA data Evatic inherits the stored SEPA-data automatically. If no SEPA data is available, IBAN, BIC and mandate reference number can be entered directly. Saving a contract is otherwise not possible without SEPA data.

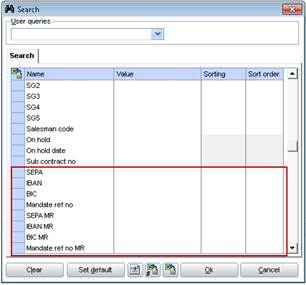

Search for SEPA-criteria

Search fields for SEPA criteria are embedded in the following Evatic searches:

- Order

- Invoice

- Customer

- Contract